Streamline your global payment processes with secure, scalable solutions built for forex and CFD businesses. Ensure fast and efficient payouts, no matter the volume.

Foreign Exchange

We deliver bespoke payment solutions that cater specifically to the needs of forex and CFD businesses. Supporting a wide range of currencies and regions, our platform makes handling global transactions straightforward and seamless.

No matter the size of your payouts, our system ensures they are processed securely and instantly to accounts worldwide. With flexible integration options, you can reduce operational complexity while maintaining complete control over your payment flows.

Flexible

Payment Options

Our payment platform is designed to keep your business compliant with ever-evolving financial regulations across multiple regions. Equipped with advanced fraud prevention systems, we provide peace of mind, ensuring your transactions remain secure and compliant at all times.

Through robust encryption and rigorous security measures, we protect sensitive data from potential threats. Additionally, we help you stay ahead of regulatory changes with ongoing updates, so your business can continue operating smoothly without interruptions.

Compliance

and Security

With payment solutions built to scale as your forex business grows, we provide flexible services that can handle increasing transaction volumes. Whether you’re processing large payouts or expanding into new markets, our platform is ready to support your growth with unmatched reliability.

Manage high-volume transactions efficiently and securely while maintaining the speed and flexibility needed to keep pace with your business expansion. With our scalable solutions, you can focus on growing your business, knowing that your payment operations are in capable hands.

Scalable

Solutions

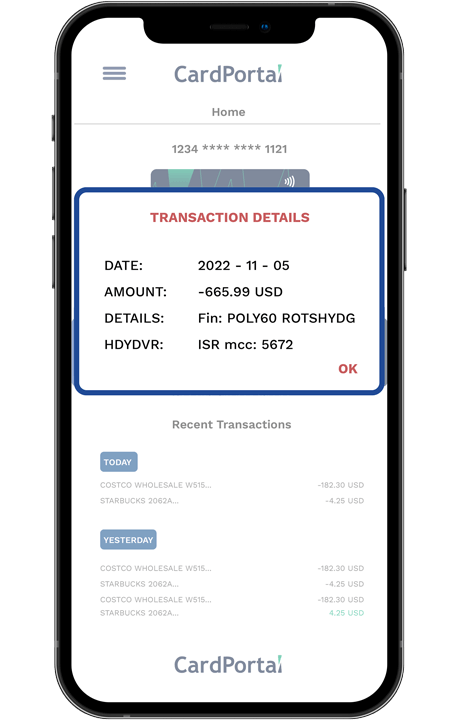

Our white-label card solutions allow you to issue branded payment cards without the need for extensive infrastructure. We provide everything you need to launch customised programmes quickly, complete with your company’s branding and tailored features.

With full control over the design and functionality, you can offer your employees and traders a seamless experience while we handle the technical and regulatory details behind the scenes. This turnkey solution enables you to enhance your brand’s presence and expand your service offerings without additional overhead.

White-Label

Programmes

Preferred Payout Methods

for Foreign Exchange

The Intercash approach is to provide a turnkey solution with all components in the issuing chain included, leaving clients free to focus on the growth of their business.

Plastic Cards

Learn More

With acceptance at over 30 million locations worldwide, plastic cards provide convenient access to funds in multiple currencies, making them a reliable option for forex and CFD traders.

Virtual Cards

Learn More

Virtual cards are perfect for instant payouts, delivering immediate access to funds without the need for physical delivery and ensuring enhanced security for online transactions across global markets.

Unlock the advantages of a custom card programme and gain full control over your Forex & CFD Businesses

Key Benefits

for Forex & CFD Businesses

Instant Global Payouts

Process real-time payments to recipients around the world with minimal delays, allowing you to meet your global payout demands no matter the destination.

Multi-Currency Support

Handle payments in a wide range of global currencies, helping you to easily manage transactions across different regions without the hassle of currency conversion.

Regulatory Compliance

Stay fully compliant with global financial regulations, minimising risk for your business and ensuring smooth cross-border transactions.

Enhanced Security

Benefit from advanced fraud prevention, encryption and secure payment processing, ensuring that all of your transactions are protected.

Seamless Integration

Easily integrate our payment platform into your existing infrastructure with our suite of APIs, allowing for quick adoption with minimal disruption.

Reduced Operational Complexity

Streamline payment workflows with our centralised back-office platform, reducing manual tasks and improving operational efficiency for your business.

Case Study

The Merchant

Our client is a renowned provider of advanced trading solutions, catering to professional traders across the globe. With a focus on innovation and precision, they have built a strong reputation as a trusted partner in the foreign exchange and CFD markets.

Convenient payout solution with multi-currency support

Need

Foreign Exchange

Industry

British Virgin Islands

Head Office

The Challenge

Despite their extensive industry expertise, the merchant faced significant challenges in managing seamless payouts to traders spread across multiple regions. Their existing processes struggled to keep up with the demands of real-time payments, handling a broad spectrum of currencies, and ensuring transactions were both secure and compliant. They needed a solution that could not only streamline financial operations but also provide a scalable framework to support their growing global network of traders.

The Solution

Intercash delivered a customised payment solution specifically designed to address the complex requirements of the merchant’s global trading network. Through our secure and efficient card programmes, they gained the ability to execute real-time payouts in multiple currencies, ensuring fast and hassle-free transactions for their traders.

Our scalable infrastructure integrated seamlessly with their existing systems, simplifying their operations and enhancing efficiency. With a strong focus on compliance and security, our solution provided the reliability they needed to confidently expand their reach and support a growing trader base.

Results

Reduced transaction times, enabling real-time payouts and improved operational efficiency.

Simplified payments in various currencies, offering traders localised options without FX hassles.

Streamlined processes and real-time payments fostered trust and stronger trader relationships.

Supported expansion into new regions with ease, thanks to a flexible and scalable infrastructure.

Ensured transactions were secure and fully compliant with global regulatory standards.